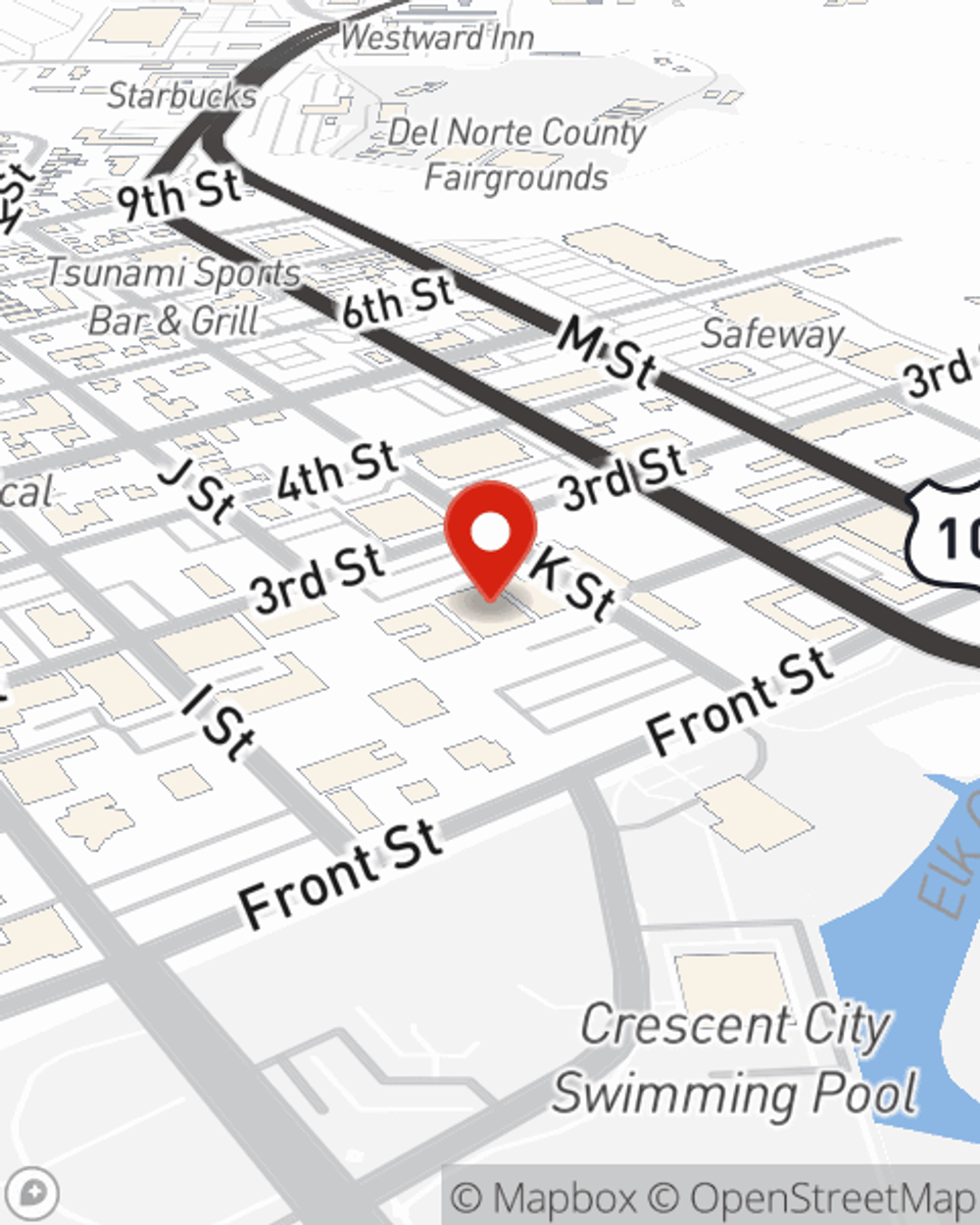

Business Insurance in and around Crescent City

One of Crescent City’s top choices for small business insurance.

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

One of Crescent City’s top choices for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Lisa McKeown is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Lisa McKeown can help you file your claim. Keep your business protected and growing strong with State Farm!

Intrigued enough to explore the specific options that may be right for you and your small business? Simply contact State Farm agent Lisa McKeown today!

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Lisa McKeown

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.